20+ pay off my mortgage

So if your outstanding loan balance in year two is 295000 and you pay your. Refinancing your mortgage to pay it off early only makes sense if you can get a lower interest rate or shorten the loan term.

Should You Pay Off Your Mortgage Before Retirement There Are Pros And Cons

Web Mistake 4.

. Web Its capped at 2 percent in years one and two and 1 percent in year three. Paying off your home is like investing in a secure interest-bearing taxable account paying the rate of your. Investment returns outstrip mortgage rates in the long term.

But before doing anything be sure to check with your lender to understand if there are any fees. It also eliminates one of the biggest monthly bills that most families have. Plus what to consider before putting your hard-earned cash toward early mortgage payments.

Web Justin Jaffe. Web 1 hour agoBy Val Cipriani. Web Assuming you have a 200000 30-year mortgage at a 4 interest rate youd need to pay about an extra 500 a month toward your principal to drop your.

Or even refinancing to shorten your loan term from 30 years to 20 or 15 instead. Web Paying off a mortgage early reduces your debt and saves you money on interest but there are a few things to consider before you pay off a home loan. Web If you are considering paying off your mortgage you can request a payoff amount from your lender or servicer.

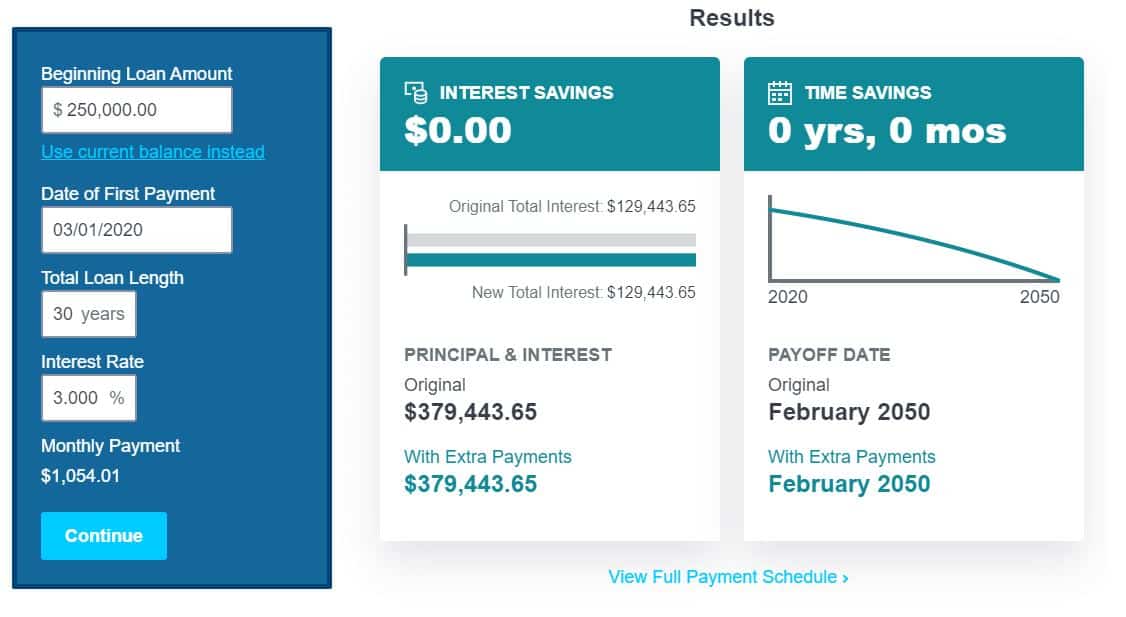

It could also backfire. Web Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments. If your loan is a closed-end loan secured by a.

A variety of important mortgage rates increased over the last seven days. Overpaying your mortgage first and investing later can pay off in certain circumstances. Web James Kinney certified financial planner Bridgewater New Jersey.

Web Here are five ways to pay off your mortgage faster. Before you even get a mortgage you can prepare to pay it off early by making a 20 down payment on your new home. Web First you can only deduct interest you pay on the first 750000 of your home loan it used to be up to 1 million but the Tax Cuts and Jobs Act TCJA changed.

Web Generally its not a good idea to withdraw from a retirement plan such as an individual retirement account IRA or 401 k to pay off a mortgage. Web Paying off your mortgage provides peace of mind and true ownership of your home. Throwing every extra penny youve got at your mortgage is an aggressive way to get out of debt.

With a smaller down.

17 Actionable Ways To Pay Off Your Mortgage In 5 Years Arrest Your Debt

Should I Pay Off My Mortgage

Payoff Mortgage Early Or Invest The Complete Guide Mortgage Payoff Pay Off Mortgage Early Mortgage Tips

17 Actionable Ways To Pay Off Your Mortgage In 5 Years Arrest Your Debt

Downloadable Free Mortgage Calculator Tool

How To Pay Off A Mortgage Early

10 Ways To Pay Off Your Mortgage Faster The College Investor

Mortgage Payoff Calculator Accelerated Mortgage Payment Calculator With Extra Payments

Mortgage Payoff Calculator Ramsey

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

How To Pay Off Your Mortgage Fast Keith And Kinsey Real Estate Keith And Kinsey Real Estate

:max_bytes(150000):strip_icc()/178281586-5bfc392bc9e77c0026342666.jpg)

Should Retirees Pay Off Their Mortgages

Mortgage Loan 20 Best Options Loanz 360

Pay Off My Mortgage Loan Early Or Continue To Make Payments

Early Mortgage Payoff Calculator How Much Should Your Extra Payments Be Nerdwallet

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

How Mortgage Interest Is Calculated

Pay Off Your Mortgage In 3 Years The 4 Step System That Will Save You Years And Thousands In Interest Payments Kindle Edition By Blankenstein Eric Arts Photography Kindle Ebooks Amazon Com